What the hell is an NFT?

It's 1911, and you are an art collector of questionable morals. You have just been contacted by Eduardo Marqués de Valfierno, an Argentine conman, and a purveyor of stolen art. The prize - the yet to be stolen Mona Lisa. He will be assisted by Vincenzo Peruggia, the Italian artist, and soon to be Mona Lisa thief.

The theft takes place, and is announced to the world. Even Pablo Picasso is arrested on suspicion of theft.

In comes Valfierno, and offers you the Mona Lisa. It passes basic sanity checks - the age of the paint and the canvas seem authentic, and the style seems consistent with that of Leonardo da Vinci's. And the whole world knows it has been stolen. You have struck gold - and buy the Mona Lisa off Valfierno for your private collection.

Only, he also sold identical copies to five other wealthy collectors of similarly questionable morals. You can now join them all for a drink at the country club.

This could all have been avoided if they were buying an NFT instead. Da Vinci's public key would have been enough to verify the provenance of a piece of art, and Valfierno's attempts at selling a forged Mona Lisa would have failed.

I want you to remember one word - scarcity. We will revisit this later. The fundamental thesis for the value of NFTs is built around uniqueness and scarcity.

What does Non-Fungible mean?

In simple words, a non-fungible item doesn't have a like-for-like replacement.

A bar of gold is like any other bar of gold, assuming they are all of the same purity grade. Our usual, central bank issued currency notes are fungible. When you buy groceries, the only thing that matters is the correct amount you need to pay. The checkout clerk (or machine) does not care about the exact serial number of the currency notes you are paying with.

We assign value to currency notes, or gold bars, based on what they represent, and not due to any unique characteristics they possess.

If you are dealing with a rare Pokemon Card, or a Mona Lisa, no two are alike, regardless of how many copies you can find on Etsy. In other words, they are unique, and cannot be replaced with a similar item. Like-for-like does not exist for these items.

What is a Token?

Shermin Voshmgir in her book "Token Economy" defines a token as a "programmable assets or access rights, managed by a smart contract and an underlying distributed ledger such as a blockchain network."

In other words, a token is a few lines of code that grants you access to something you own, or something someone else owns. Aside from establishing access to, or ownership of an asset, tokens also allow us to manage digital uniqueness (just like their physical counterparts), and scarcity.

Tokens can be fungible, as in the case of BTC (the Bitcoin network's token) or ETH ( the Ethereum network's token), where we don't really care about the unique ID of the token. 1 BTC is equal to 1 BTC, regardless of its unique token ID.

Non-fungible tokens on the other hand are uniquely identifiable, and their ownership and provenance is recorded on the blockchain. The creator of the token signs it with his public key, which allows you to conclusively prove the authenticity of the token. This token can grant access to (or ownership of) an image, a music file, a video, a private members club, or any other such experience.

The NFT Ecosystem

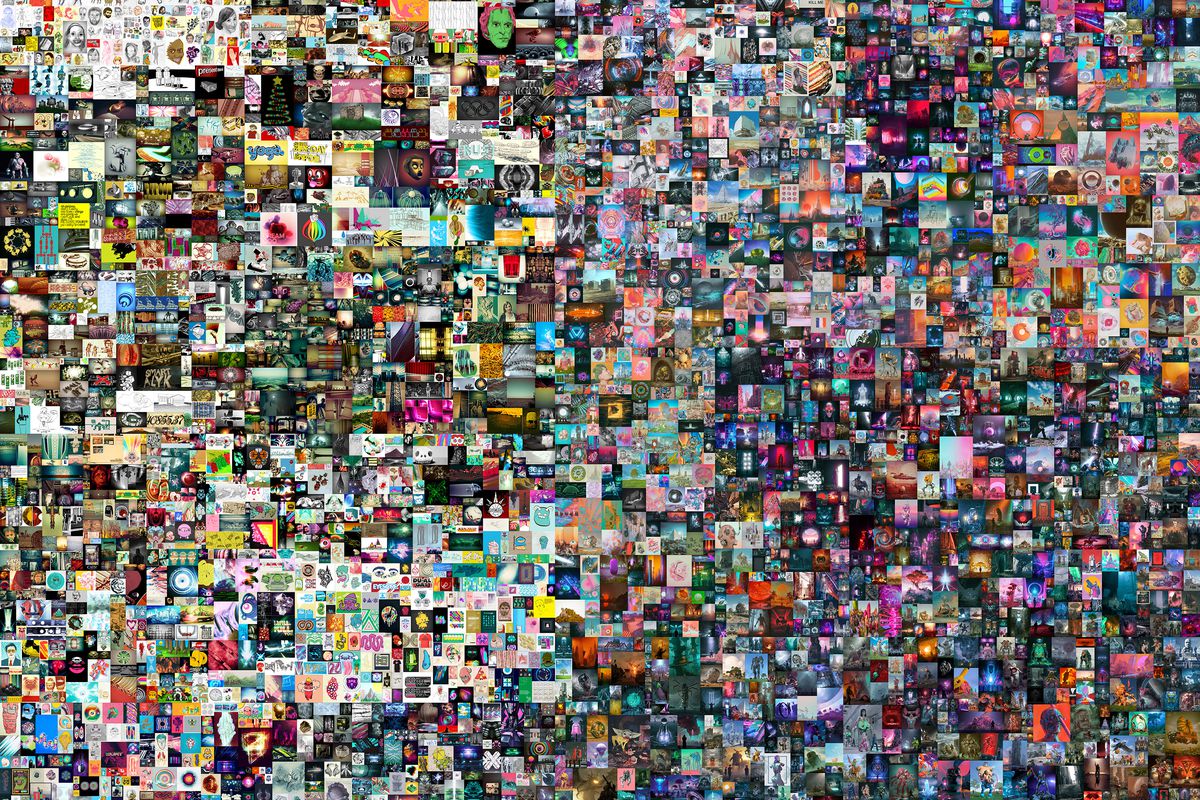

NFTs have been in the media recently, mainly due to high amounts of money being paid for art that could actually be created by a drunk monkey tripping on acid. Mike Winkelmann, known popularly as Beeple, sold an NFT for $69 million - artistically, this is not too far off from what our simian cousins could piece together given enough time, and bananas for motivation.

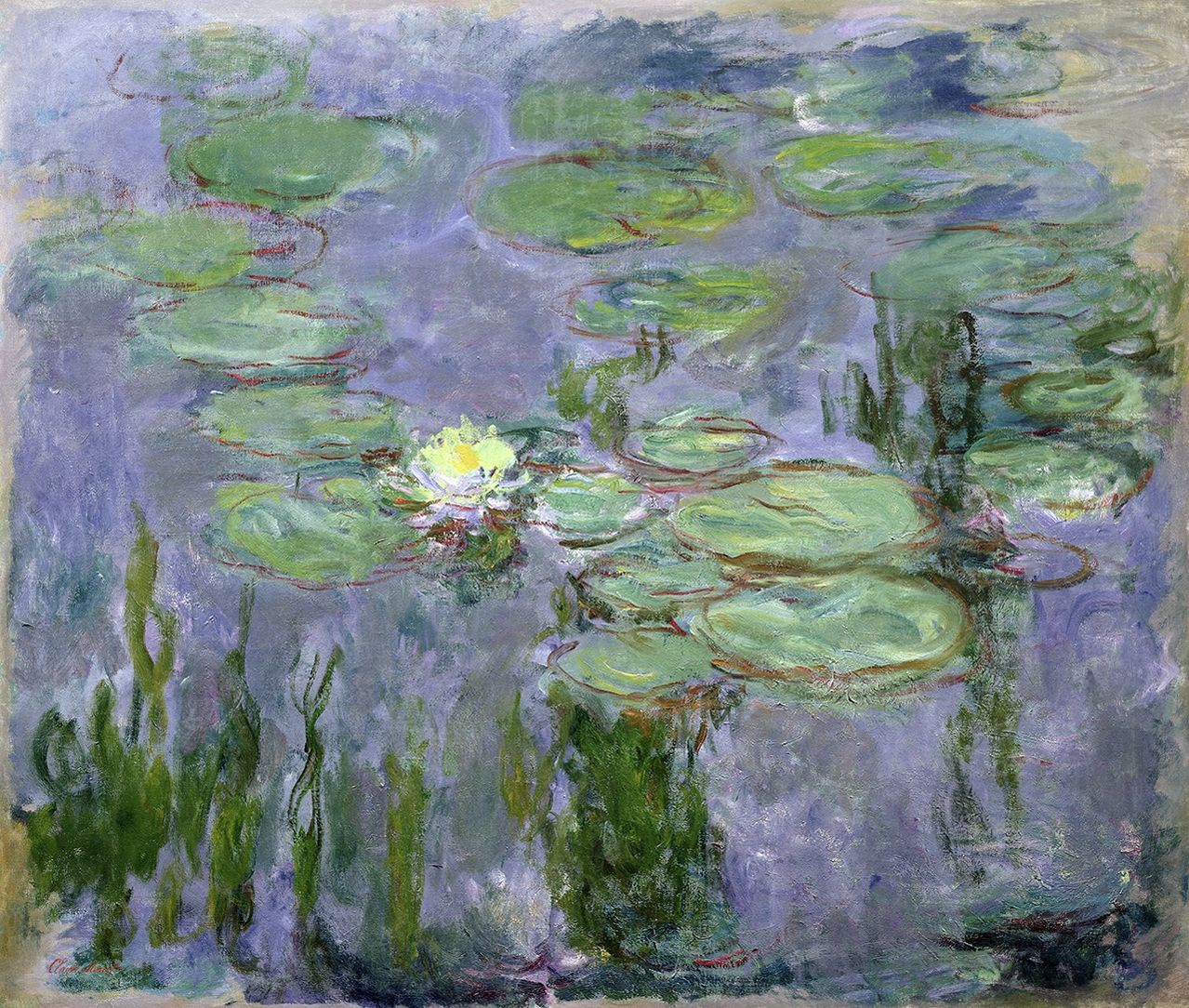

To put that into perspective, Nymphéas by Claude Monet is estimated by Sotheby's to be between $30 and $45 million.

Drunken Monkey on Acid art can't qualitatively beat a Monet. So what gives?

Utkarsh Amitabh at Network Capital writes on this issue:

The one thing people are willing to pay for is deeper connect or greater access with people, organizations and communities.

He posits that this is down to the Access Economy, where the 'job' of the NFT is not just utilitarian, but also generating a unique experience for the owner of the token. It would then appear that the techno-savvy are willing to ascribe greater value to deeper access, and a unique digital experience. This access differential could be one reason why similar art by the same artist is also valued so differently.

This is where the Fear of Missing Out (FOMO) comes in. An NFT has scarcity built into it, and this is achieved by various approaches. Some NFT releases have a limited run of a few pieces. A few others are generated algorithmically.

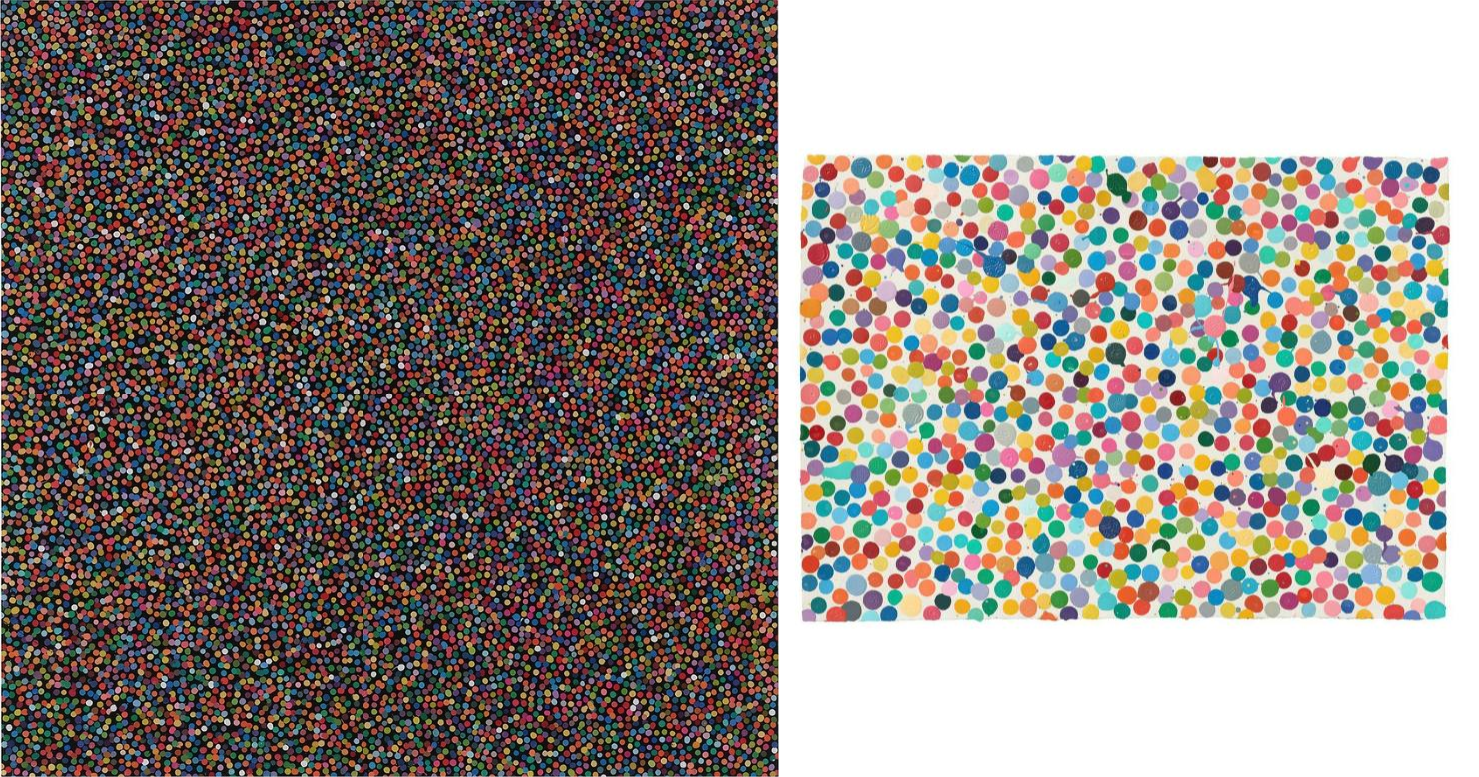

As an example, the Cafe Royal series of 100 pieces by artist Damien Hirst is valued at roughly $15-20,000 per item. It's a large piece at 90x90cm.

An NFT called 'The Currency', a series of 10,000 pieces, has a floor price of around 14 ETH on Opensea - that's roughly $45000. This NFT can be traded for its physical counterpart, which is an A4 sized sheet. Doing so would destroy the NFT. If at sometime around 2022, the physical version is unclaimed, that A4 sized sheet will be burned.

The Currency has it's own community online, where others interested in the piece get together to discuss it. Does that alone justify a nearly 3X valuation? Is the perceived scarcity of a chimp cartoon (BoredApeYachtClub) really worth over a $100,000? Time will tell.

Other Applications

NFTs have opened up a whole new way for artists and creators to monetise their content. Sticking with the earlier example of the artist Damien Hirst, secondary sales of physical pieces of art will not provide him any royalty.

Any sales of his NFT will generate royalty in perpetuity (if it is so programmed). Technologies such as these will continue to eat away at the utility provided by intermediaries and brokers. Would you really need a gallery or a broker if your avant-garde art resides in your digital wallet? Will we value digital art as much (or even more than) art in its physical form?

That is not to say that brokers or platforms will disappear. Fans of Shrek, for example, can buy rights to to the music from the franchise for about 250 ETH, and each seller, and the platform can expect up to 5% of the sale price.

Bands can directly transact with their fans, artists can create art and incentivise patrons to engage with them and buy, and even physical assets can have time bound access assigned to the user. Value creators and value consumers interacting directly will mean that there will be less for the brokers to do, however.

As the space matures, we will definitely see a fall from the current price levels. My reading of the situation is the prices are fuelled by a combination of community, utility, and good old fashioned FOMO.

However, with our ability to better support people and entities we value, this can be a long term win-win for everyone involved. And never again shall an innocent Picasso be arrested.

Member discussion