Is Management Consulting getting disrupted?

Hypothesis: a supposition or proposed explanation made on the basis of limited evidence as a starting point for further investigation.

Here's a starting point for further thought, and investigation: The MBB (McKinsey, BCG, Bain) consulting group in its current form is a dying industry.

Caveats

- This is not an anti-MBB post

- My hypothesis is restricted to what they currently do

- I have no insights into their internal workings, just views from outside-in

Here are a few reasons why I have this view.

1. The smartest minds no longer want to work at MBB

They want to work in Silicon Valley (or its local variant). This is partly an economic problem.

Many of the talented people who are drawn towards tech firms are attracted both by the quality of the problems being tackled, as well as the potential asymmetric upside on getting it right. So putting in 100 hour weeks isn't that tough a sell when you have a dangling carrot of vesting stock options, in addition to the immense intellectual puzzle they get to work on. On the other hand, MBB associates are expected to work really long hours, with no participation in the upside.

Not only that, the rise to the top is even less uncertain now. Making Partner at an MBB firm was always a challenge, but given the changing industry dynamics, the process is only going to get tougher.

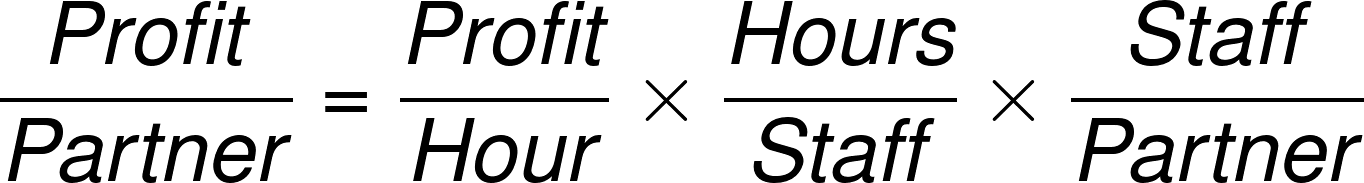

As the pressure on the hourly profit rate increases, the other two levers available will be to increase the hours that people have to work, while reducing the number of partners in the firm (in the long run). That's not a position one would like to find themselves in when joining a firm.

Another challenge is the roadblocks experienced hires face in joining these firms. Granted that management consulting firms expect high standards from their people, but so do the likes of Tesla, Google, Facebook, Nvidia. Without bringing in experts with hands-on experience in solving major problems, MBB is not in a position to add significant value.

A tangential point - cost reasons aside, this is also a major driver of many larger corporations establishing their internal consulting divisions, since executing strategy is a skill in itself.

2. Insight has been democratised

The MBB group is no longer the most dominant supplier of insights and analysis frameworks. Business analysis frameworks such as the BCG Matrix or the 7-S Model are no longer the purview of the MBB group - some of the most widely used models such as the Lean Startup, Business Model Canvas, Four Steps Framework etc come from non-consultants.

Further, Open Source and proprietary datasets are widely available, and data scientists are creative insight generators of the modern world. Building data pipelines, executive dashboards, and predictive analytics capabilities are fairly par for the course for most modern companies, with tools such as Tableau, Microstrategy and Looker being ubiquitous.

There is also a growing, albeit currently niche, segment of technology driven insight generating tools such as Strategyzer which have grown in sophistication in a span of a few years.

3. Networks

The MBB alumni network was one of its key strengths. This strength manifested in at least two ways - alumni would be a key sales channel, while also being a group of experts who could be relied on for insights on specific problems.

They now have to contend with other equally influential, global networks such as Thiel Fellows, OnDeck Fellows, YC Alumni, 500 Startups Alumni, etc. Former consultants lead niche firms like Eden McCallum are also another source of competition.

Another area that is a recent development is Distributed expert networks such as GLG Insights, Guidepoint, AlphaInsights, where globally recognised experts on a given topic can be accessed at short notice. This is obviously a cheaper substitute to what the likes of McKinsey or BCG would provide, but there is some precedent here. As has been the case many times, sometimes, the cheaper, feature-reduced product is good enough. After all, people pay for insights and information, not for tenure.

4. Nature of Big Business has changed

In the year 2000, the top-10 companies by market cap were:

- General Electric

- Exxon

- Pfizer

- Citigroup

- Cisco

- Walmart

- AIG

- Intel

- Merck

In 2022, the top 10 companies are:

- Apple

- Microsoft

- Amazon

- Tesla

- Alphabet

- NVIDIA

- Berkshire Hathaway

- Meta

- UnitedHealth

Market share is no longer a predictor of sustained growth or excellence (as per BCG's own analysis), conglomerates are nearing extinction, and new business models leveraging technology and automation reign supreme. MBB has little value to add there - nothing that a team of in-house Data Analysts and Business Analysts cannot explore together.

5. MBB Innovation arms/incubators/venture studios are ineffective

They have been around for at least a decade, and have nothing to show for it. While not a like for like comparison, in the past decade or so, the likes of Techstars, Plug and Play, ERA etc with their corporate venture partnerships have a lot more results to speak of than anything coming out of an MBB innovation studio.

This is partly a self-selection problem - if you had bright, multi-million dollar ideas, you would be raising capital for your own firm, not making Powerpoint slides. So what you are left with is a group of very smart, but risk averse people trying to figure out how other people (or companies) should take risk.

The Way Forward

The MBB Group will likely continue being relevant (and even required at times) in highly regulated industries such as Banking, Energy etc. Their stamp of approval on numbers and/or strategy is still worth a lot in those circles. Within that context, their value is in being the external quality assurance team, not necessarily the expert implementors.

Geographically, the emerging markets are likely to be growth engines for them, since many governments in those markets have significant ambitions (and budgets) to improve various aspects of their functioning.

That being said, it will be interesting to see how the management consulting industry negotiates the competition from Data Science-as-a-Service firms such as Fractal Analytics, Palantir, Mu Sigma etc, as well as tools that enable insight generation in house (such as Tableau, MicroStrategy, Dataiku etc.)

Member discussion