Mohnish Pabrai: The Anti-Fund Manager

The fund management world is a very complex, very interesting one. Nowhere else will you find such a concentration of some of the brightest minds on the planet, who are also chronic underachievers. This is the domain of some of the best Wealth-to-Mediocrity ratios of any industry on the planet. How else would you explain this simple fact - since its inception in January 1994, the Credit Suisse Hedge Fund Index (7.40%) significantly lags the S&P 500 (10.69%).

Who would have thunk it, 'Sit On Your Ass'1 investing beats Caviar and Champagne Extravagance. Fred Schwed's book, Where are the Customers' Yachts?, written in the 1960s is still relevant today.

This is where fund manager, and author of the best selling book 'The Dhandho Investor', Mohnish Pabrai, is so different. His flagship fund (PIF-2) returned 12.1% on average between the years 2000 and 2019, as opposed to the S&P 500 which returned 6.4% during the same period2. This becomes even more impressive for his Limited Partners when factoring in the unique fee structure he has (discussed later in the post).

Fund returns are not the only measure of the man, however. Emulating his intellectual hero Warren Buffett, he gives away his wealth, working directly with students from economically backward communities in India. For these students, getting into engineering or medical school can be life changing and has the ability to uplift an entire family in the span of a generation. Over the years, I have followed his numerous lectures, interviews, and blog posts with great interest, always walking away with a sense of awe about how he leads his life too.

Here are some of his ideas that most resonated with me.

1. Heads I win, tails I don't lose much

The Dhandho Investor starts with the example of Indian entrepreneurs in the United States who got into the motel business. Despite their humble beginnings, collectively, they own over half of all motels in the United States. Pabrai writes about their unassuming origins, enterprising spirit, and a willingness to take bets with outsized payoffs. Two such characters chronicled in the books are 'Papa' Patel, and Manilal Chaudhary. Both worked long hours, saved diligently, and when the opportunity arose, took a bet that changed their lives. Both bought motels at distressed prices, knowing that they could keep costs low, while serving a superior product. And if they were to ever lose their business, they could restart again in a few years. Or as Mohnish Pabrai puts it,

Heads I win; Tails I don't lose much.

They essentially turned a non-Ergodic event (permanent loss of capital) into an Ergodic one (the ability to restart). Most of investing, is after all, about removing the risk of permanent loss. Both Papa Patel and Manilal limit their downside, and ensure continued survivability.

2. Identify hidden incentives

There are many factors that could explain the under-performance of the fund management industry, however, to me the most important one is misaligned incentives. A majority of fund managers get compensated regardless of performance. This structure is called the 2-20 Model - managers charge a fixed fee (usually 2% of assets under management), along with a performance fee (20% of the profits in this case). Some also add a hurdle rate.

While most fund managers live off the hefty management fees, Pabrai's fund doesn't charge any and instead, he only charges a performance fee, along with a hurdle rate. This is similar to how Warren Buffett and Charlie Munger managed their own funds, before coming together to run Berkshire Hathaway.

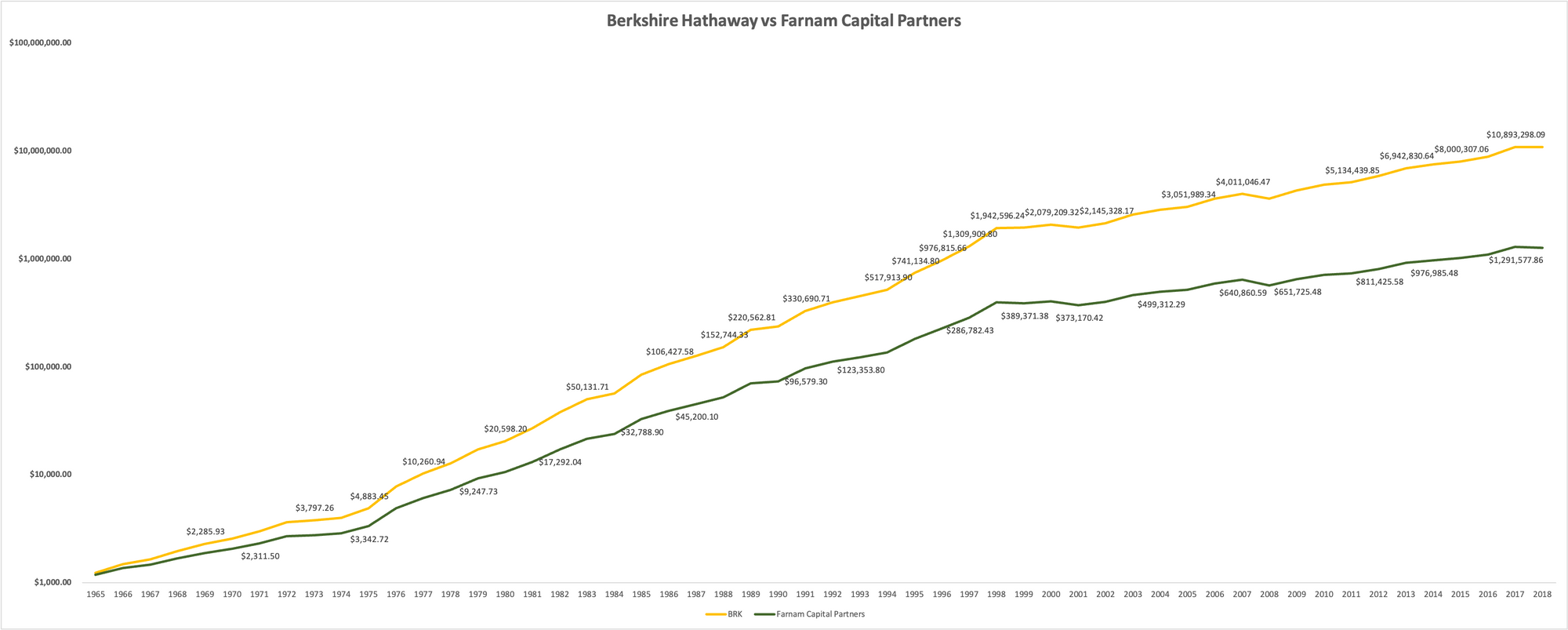

Inspired by Vikas Bardia's post, I ran the numbers for Berkshire Hathaway (since the linked excel file is gone). The results are striking!

If you were to invest $1000 into Berkshire Hathaway in 1965, it would have grown to over $1 million by 1997, and to nearly $11 million by 2018. On the other hand, its fictional hedge fund counterpart Farnam Capital Partners would have returned just about $1 million by the end of 2015, while generating about $500,000 in fees for the fund (assuming a standard 2/20 model, and a 6% hurdle rate).

Berkshire Hathaway vs Farnam Capital Partners

Wouldn't you rather that your fund manager feel the same pain as you, when your fund underperforms?

3. There is no shame in cloning successful ideas

“I’m a shameless copycat. Everything in my life is cloned…I have no original ideas.”3

Why re-invent the wheel, when there are time tested ideas that work so well? Pabrai has 'cloned' many aspects of his fund based on the life and work of other successful investors, such as Warren Buffet, Charlie Munger, Nick Sleep, Guy Spier et al. The 'No Management Fee' policy for example, comes from Warren Buffet and Charlie Munger. Although Pabrai calls it cloning, I would say it is closer to reverse engineering. Good ideas are rare, and great ideas even more so. And when we can learn from the best in the business, why let go of such an opportunity?

4. Focus, like Arjuna

In the Indian epic Mahabharata, one of the key characters is a warrior named Arjuna, an archer with the ability to shut out all noise and just focus on the target.

Quite the same, Pabrai urges investors to be like Arjuna - ignore the noise and focus on the quality of the business. Forget the Fed, the interest rates, the rise and fall of Bitcoin, or whatever your favourite celebrity stock analyst has to say on CNBC or Bloomberg. The only thing that matters is that it is a high quality business, in your circle of competence.

5. Few Bets. Big Bets. Infrequent Bets

And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.

Charlie Munger, USC Business School, 1994

The markets don't hand out participation trophies, or give you medals for length of service. The rewards come from identifying mis-priced opportunities that yield asymmetric payoffs.

Consider the 6000 or so public companies in the United States. Let's throw away half of them for being too small, or having very little trading volume to be of analyst interest. The remaining 3000 across industries will have analysts covering them extensively, poring over every detail with a magnifying lens.

In a market where there is already so much information, the chances that you are correct about a thesis, while also being a contrarian, will be small. They exist, but those opportunities will come by very infrequently.4

Howard Marks' 2X2 matrix is a great mental model to understand where asymmetric returns lie in investing. Here is my own rendition of it.

Howard Mark's 2X2 Matrix

You have to be correct about your thesis, and you have to be contrarian. Anything else will not be good enough.

In other words, you have to wait for your unique insights, your earned secrets to useful.

In a world of algorithmic convergence, Mohnish Pabrai stands out for charting his own path, and for carrying on the intellectual legacy of Warren Buffett and Charlie Munger.

Here are some links to learn more about him and his ideas:

- Website: http://www.chaiwithpabrai.com/

- The Dhandho Investor: https://amzn.to/3uByyMR

- The Dakshana Foundation: https://www.dakshana.org/

- Addressing students at Brown University: https://www.youtube.com/watch?v=p5xt09gAi-U

- "The Ten Commandments of Investment Management", Addressing students at Boston College: https://www.youtube.com/watch?v=9tGjXPhnp-s&t=397s

References

- "The investing where you find a few great companies and just sit on your ass because you’ve correctly predicted the future, that is what it’s very nice to be good at." - Charlie Munger during the morning session, Saturday Apr 29, 2000 https://buffett.cnbc.com/video/2000/04/29/morning-session---2000-berkshire-hathaway-annual-meeting.html

- Pabrai Investment Funds letter to Limited Partners and Investors, 10 Jan 2020 https://snowballing-co.s3.amazonaws.com/media/l_010120.pdf

- https://www.chaiwithpabrai.com/uploads/5/5/1/3/55139655/the_one_percent_podcast_-_mohnish_pabrai_-_transcript__final_.pdf

- To paraphrase Warren Buffett's baseball analogy, success in investing comes from watching pitch after pitch go by, and waiting for the right one in your sweet spot.

Member discussion