Silicon Valley Bank is Dead. Long Live SVB!

In 2018, Silicon Valley Bank made an offer to acquire us. We had been working with them for a while, and they knew our product and offering.

The money would have been life changing for me, and the tag of being a founder whose startup got acquired would have helped me in my next startup, whatever that might have been. Alas, that was not to be!

We met radio silence after receiving our term sheets. Hope turned into despair, which turned into resignation to the fact that the money was never coming in. That despair fuelled us to innovate further, and to quote Steve Jobs, one can only connect the dots looking backwards - but Tribal would never have been created had we been acquired. And to think, our stock from the cash + stock deal would have vested just about now. I have fond memories of that time, and nothing but appreciation for and gratitude towards the people we were working with at SVB.

On Friday, 10th March 2023, Silicon Valley Bank was shut down by the regulators, appointing the Federal Deposit Insurance Corporation (FDIC) as receivers. This is the second largest bank failure in American history. If this were a regular retail bank you walk past every morning on your way to work, the FDIC stepping in would have been the assurance you needed. SVB's unique positioning means that the FDIC guarantee is almost pointless.

Opening a bank account with SVB was almost a rite of passage for startups that raised capital. You couldn't just walk into a branch to open an account - there were no 'branches' as such. And this is where the FDIC's assurance becomes meaningless.

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank. For example, if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B, the amounts would each be insured separately up to $250,000. Funds deposited in separate branches of the same insured bank are not separately insured.

Even a run-of-the-mill seed round would make you exceed the $250k threshold. What happens to those with holdings above $250k is to be seen - much of it will depend on how much can be recovered.

And this is a gigantic problem, since an estimated 93% of the deposits are uninsured (i.e. approximately $150b).

What caused this breakdown though? How did the 16th largest bank in the United States get to this stage? As is the usual story - this is a mixture of bad luck, and bad management.

Update: See the 'Aftermath' section - the Fed has stepped in to guarantee all deposits.

Understanding Banking

To understand SVB's plight, let us first try to understand how a bank functions. I will, of course, over simplify here. A bank takes your deposit, and then invests it or creates loans using that money, keeping only a small proportion of your money at hand. This frees up capital to be deployed to more productive uses, and is a net benefit to society. Regulators monitor this process so that banks don't take undue risks. In the US, the Federal Reserve publishes reserve requirements.

In the case of SVB, there were Real Estate Loans, Commercial Loans, Credit Cards, and other consumer loans. To further give assurances to depositors, the regulators insure deposit amounts up to a certain threshold ($250,000 in the US, £85,000 in the UK).

Depositors benefit from the interest paid on their deposit, the bank benefits from the higher rate of interest on the loan, and society benefits from allocation of capital to use cases that make everyone's lives better (on average).

The underlying assumption here is that all depositors don't demand to have their deposits back at the same time. When people no longer have confidence that a bank can safeguard their deposits, it is only logical that they demand their money back. The problem is that the bank doesn't have that money lying around in their vaults. There is a mismatch of timing here - depositors seek their money instantly, while the bank has deployed their money to a variety of loans.

Back to the Beginning

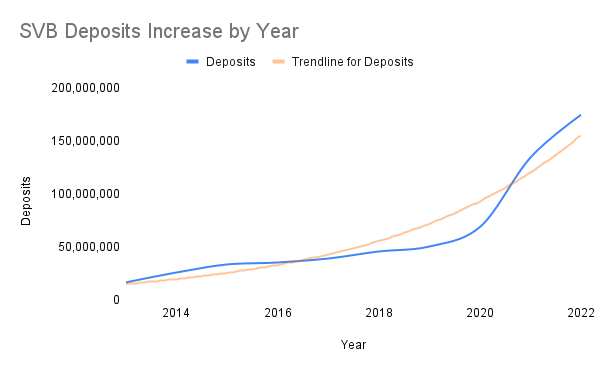

Reviewing data from the FDIC, SVB's increase in deposits is very impressive.From roughly $16b in 2013, it ballooned to a massive $174bn by 2022, and even further by 2023.

This is where the things go wrong for SVB.The ballooning deposits had to be parked somewhere, SVB decided to purchase long term US treasury bonds.

Since we know from Corporate Finance 101 classes that long dated bonds pay higher interest than short-term bonds, this makes perfect sense. Also, in 2020, high interest rates regimes didn't figure in most scenarios. However, we also know that when interest rates rise, the prices of long-dated bonds fall, since they still pay the old interest rate .

As Jospeh Wang discovered, SVB didn't hedge this interest rate exposure. A fall in Venture Capital funding rounds and amounts, the inflationary environment, tighter monetary policy, etc meant that it was the perfect storm and SVB was right in the middle of it. Another complication in SVB's case was that recent regulations had ensured that the oversight on banks with assets less than $250bn were not as stringent.

Fewer startups were getting funded, and burns rates had increased to 2x higher than levels for a similar period in 2021. The bank also had to continue increasing provisions for credit losses. It is interesting to read through the Motley Fool's coverage of the situation, speaking of SVB's 'moat' - startup and technology banking. Under normal circumstances, yes. Not when one is jumping into a ravine headfirst without a helmet.

Self-fulfilling Prophesies

Bank runs are self-fulfilling prophesies.

The term self-fulfilling prophecies refers to the observation that sometimes our beliefs about others can lead us to treat them in such a way that they subsequently become what we expect them to be. Originally, the effect was demonstrated in the classroom and called the ‘pygmalion effect.'

There is a belief that a bank is running out of cash, which makes people panic, resulting in them wishing to withdraw their funds, causing the bank to run out of money.

What triggered the fear that the bank was running out of cash?

SVB had acknowledged the prevailing market conditions, as well as the resultant losses and reductions in Net Interest Income in their Q4 Investor Presentation. By February, their deposits had plunged much faster than anticipated, as per the Financial Times. SVB's management took a call to sell nearly all their "available for sale" (AFS) securities, to reinvest the proceeds into short-term securities that were now yielding a higher return. However, this meant that they had to take a massive loss ($1.8 billion) during the sale, since the older securities offered lower interest rates from back when they were first purchased. The next day they had to sell more securities, again at a significant loss, to inject liquidity into the bank. On a completely unrelated note, the crypto banks Signature, and Silvergate collapsed.

By then, investors such as Founders Fund had recommended to their portfolio companies that they withdraw capital from SVB. Panic ensued, the bank did not have enough money to honour all such requests, and a bank run started.

Aftermath

SVB's collapse would obviously have troubled regulators and participants alike. No wonder that the Fed had to step in urgently to assure everyone that they would have full access to their deposits starting today, Monday. We don't know yet how things will unfold for the tech sector in the near future, but it will undoubtedly be challenging.

One can only hope that the Fed stepping in will bring some much needed confidence to the system and prevent any further contagion.

Member discussion